Presidential candidate Ted Cruzs tax proposal would 1 repeal the corporate income tax payroll taxes for Social Security and Medicare and estate and gift taxes. The Ted Cruz tax plan gets credit for simplifying a needlessly complex tax code as well as for encouraging business growth.

Ted Cruz S Tax Plan Is A Vat Committee For A Responsible Federal Budget

The Dallas Morning News is pushing back against Sen.

Ted cruz tax plan. Consolidation of the seven tax brackets into one bracket. Accounting for economic growth all taxpayers would see an increase in after-tax income of at least 14 percent at the end of the decade. However there is.

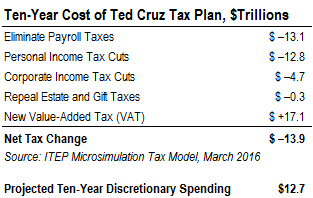

Our view Dont rule out other VATs though. Ted Cruzs R-Texas attempt to blame Democrats for the massive debt the United States is faced with as the party tries to pass the much-needed. The Tax Policy Center said Tuesday that his plan would add at least 8 trillion to the debt over the next decade.

He could still pay for his space missions and super-yachts if thats where he gets his kicks. Also a Business Transfer Tax of 16 would replace the corporate income tax and all payroll taxes. Replace income tax and IRS with FairTax.

This week Senator Ted Cruz R-TX released details of a tax reform plan. While the tax plans of the other candidates are quite impressive Cruzs is. His tax plan would lose a few trillion dollars of revenue over a decade.

Ted Cruz claims that his tax plan would supercharge economic growth boosting GDP by as much as 5 a year for a decade or more. Ted Cruzs 10 percent flat-tax plan would be simple fair and a spur to the economy. Personal exemptions would be 4000 as they.

And 3 introduce a new 16 percent broad-based consumption tax. Thats umm an ambitious goal to be sure. In recent speeches and on his website presidential candidate Marco Rubio has criticized rival Ted Cruzs tax plan for its business flat tax.

Presidential candidate Ted Cruzs tax proposal would 1 repeal the corporate income tax payroll taxes for Social Security and Medicare and estate and gift taxes. AN ANALYSIS OF TED CRUZS TAX PLAN Joseph Rosenberg Len Burman Jim Nunns and Daniel Berger February 16 2016 ABSTRACT Presidential candidate Ted Cruzs tax proposal would 1 repeal the corporate income tax payroll taxes for Social Security and Medicare and estate and gift taxes. 2 collapse the seven individual income tax rates to a single 10 percent rate increase the standard deduction and eliminate most other deductions and credits.

AN ANALYSIS OF TED CRUZS TAX PLAN Joseph Rosenberg Len Burman Jim Nunns and Daniel Berger. But the bulk of those tax cuts would flow to the. Cruz co-sponsored HR25 S155.

She reacted by promising to crank the Democrat looting spree even further into overdrive. This bill imposes a national sales tax in lieu of the current income and corporate income tax employment taxes and estate and gift taxes. Under my plan Jeff Bezos would pay a 54 billion WealthTax of his estimated net worth of 181 billion.

The tax-reform landscape is getting crowded. Senator Ted Cruz R-TX just dunked on Senator Elizabeth Warrens D-MA tax plan with his own idea about how to change the tax code. Ted Cruz at a Georgia rally on Dec.

Ted Cruz Tax Plan. 1 This plan would institute a flat 10 percent tax rate on all varieties of individual income with a large standard deduction and. 2 collapse the seven individual income tax rates to a single 10 percent rate.

The rate of the sales tax will be 23 in 2017 with adjustments in subsequent years. Esteemed countermoonbat Ted Cruz reacted to her reaction with the best tax plan yet. Morton for The New York.

It would also repeal all itemized deductions except for. A clear articulation of his critique came in a speech delivered in Sarasota Florida. Increase of the Standard Deduction from.

But the slippery slope. Adding to the proposals put forth by other candidates Ive previously reviewed the plans offered by Rand Paul Marco Rubio Jeb Bush Bobby Jindal and Donald Trump we now have a reform blueprint from Ted Cruz. A tax plan proposed by Republican presidential candidate Ted Cruz would cut federal revenues by 86 trillion over 10 years adding substantially to the debt according to an analysis published on.

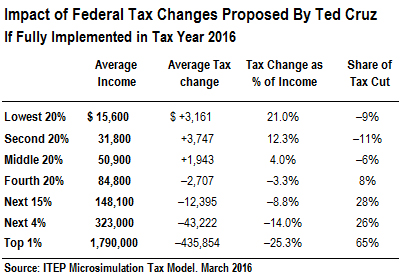

Ted Cruzs flawed tax plan. The Cruz plan would cut taxes for everyone in 2017 by an average of 6100 boosting after-tax income by 85 according to the Tax Policy Center. As we have explained in our more detailed piece explaining the business flat tax it is designed as a subtraction-method value-added tax VAT.

Texas Senator and Republican presidential candidate Ted Cruz has presented his own tax plan for America. Ted Cruzs tax plan includes for individuals. Ted Cruz has promised to abolish the Internal Revenue Service if hes ever elected president so you might fairly assume that his tax plan.

Presidential candidate Ted Cruzs tax plan calls for a simple flat tax of 10 on individual income. Writing for the Wall Street Journal the Texas Senator unveiled his rewrite of the tax code. When the federal budget began running annual deficits topping 1 trillion during the Great.

2 collapse the seven individual income tax rates. Republican presidential candidate Ted Cruz has proposed one of the most radical. Imposition of a 10 flat tax on individual income.

2 This week Senator Ted Cruz R-TX released details of a tax reform plan1 This plan would institute a flat 10 percent tax rate on all varieties of individual income with a large standard deduction and personal exemption. Senator Ted Cruz unveiled his Simple Flat Tax Plan on 102815 just before the Presidential Debate in Boulder Colorado. Typical commie Elizabeth Warren was enraged that Jeff Bezos spent some of the money that he earned reaching for the stars.

A standard deduction of 10000 up from the 6300 standard deduction a taxpayer could claim during the 2015 tax season. In which John compares the tax proposals of Republican presidential candidates Ted Cruz and Donald Trump and also discusses the current US. Cruzs plan would allow for.

Ted Cruzs Simple Radical Tax Plan.

Indian Culture Essay Writing In 2021 Essay Examples Essay Writing Essay

Ted Cruz S Tax Plan Would Cost 13 9 Trillion While Increasing Taxes On Most Americans Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Pin On Trending Business Daily News

If You Have Preexisting Conditions Some Insurance Companies Won T Cover You In 2020 Funny Tweets Hilarious Ted Cruz

Senator Ted Cruz S Tax Reform Plan Committee For A Responsible Federal Budget

Senator Ted Cruz S Tax Reform Plan Committee For A Responsible Federal Budget

The Irs Adds Targets To Its Audit Strategy The Large Business And International Division Announced The Addition Of 11 Targeted Issu Swiss Bank Tax Credits Irs

:watermark(cdn.texastribune.org/media/watermarks/2016.png,-0,30,0)/static.texastribune.org/media/images/2016/02/26/Cruz_IRS_TTcrop.jpg)

Pressing Donald Trump For Tax Info Ted Cruz Releases His Own The Texas Tribune

Ted Cruz S Tax Plan Would Cost 13 9 Trillion While Increasing Taxes On Most Americans Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Aqua Stainless Steel Professional Business Card Zazzle Com Professional Business Cards Business Cards Personal Business Cards

This Is Why You Should Stay Away From Pirated Games Free Antivirus In 2021 Anti Piracy Video Games Piracy

Ted Cruz S Tax Plan Is A Vat Committee For A Responsible Federal Budget

Ted Cruz S Response To Elizabeth Warren S Stupid Tax Plan Is The Best Freaking Idea In The History Of Politics Not The Bee

Senator Ted Cruz S Tax Reform Plan Committee For A Responsible Federal Budget

YOU MAY LIKE :